car sales tax wake county nc

The state sales tax or highway use tax rate is 3. Do I have to pay sales tax on a used car in North Carolina.

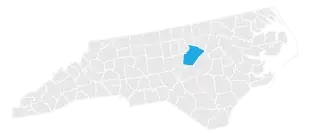

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

. PO Box 25000 Raleigh NC 27640-0640. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. There is no applicable city tax.

Johnston County Tax Administration Office. Find The Best Deal On Your Next Car. Motor Vehicles are valued by year make and model in accordance with the North Carolina Vehicle Valuation Manual.

Ad Determine Monthly Payment Trade-In Value And More Before Going To The Dealer. This is the total of state and county sales tax rates. You can find these fees further down on the page.

North Carolina Department of Revenue. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. Use the Wake County Tax Portal to view property details research comparable sales and to file a real estate appeal online.

North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. Take your time or go fast. Do North Carolina vehicle taxes apply to trade-ins and.

See how it works. As an example if you purchase a new truck for 60000 then you will have to pay 1800 in taxes. The minimum combined 2022 sales tax rate for Wake County North Carolina is.

The 2018 United States Supreme Court decision in South Dakota v. The Minimum Combined 2022 Sales Tax Rate For Wake Forest North Carolina Is. Sales tax in wake county north carolina is currently 725.

025 lower than the maximum sales tax in NC. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. Wake County Tax Portal.

The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. Get more information on appealing vehicle personal and real property tax values. Division of Motor Vehicles collects as defined by law on behalf of counties Revenue from the highway-use tax goes to the North Carolina.

Children. Historical Total General State Local and Transit Sales and Use Tax Rates. What is the sales tax rate in Wake County.

Box 451 Smithfield NC 27577 Administration Mailing Address. See reviews photos directions phone numbers and more for Wake County Car Taxes locations in Wake Forest NC. In addition to taxes car purchases in North Carolina may be subject to other fees like registration title and plate fees.

Well go at your speed when you purchase a car with Enterprise. Browse Millions Of New Used Listings Now. Vehicles are also subject to property taxes which the NC.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. There is a 3 highway use tax on used vehicle sales in North Carolina. Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates.

Johnston Street Smithfield NC 27577 Collections Mailing Address. Although the process of assessing annual vehicle property taxes may seem somewhat complex the nc vehicle sales tax is relatively straightforward. Johnston street smithfield nc 27577 collections mailing address.

Ad Experience fast easy and transparent car buying. What is the sales tax on a car purchased in North Carolina. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

The Wake County sales tax rate is. For tax rates in other cities see North Carolina sales taxes by city and county. The North Carolina state sales tax rate is currently.

The wake county sales tax is collected by the merchant on all. Box 368 Smithfield NC 27577. For vehicles that are being rented or leased see see taxation of leases and rentals.

You can print a 725 sales tax table here.

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Wake Forest Cares Town Of Wake Forest Nc

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

Wake County Nc Property Tax Calculator Smartasset

Wake Forest Neighborhood Concerned Over Rash Of Car Break Ins Wral Com

Wendell North Carolina Nc 27591 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Used Chevrolet Camaro For Sale In Raleigh Nc Cars Com

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Raleigh North Carolina Nc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Deputies Rash Of Luxury Cars Broken Into Stolen In Wake County Wral Com

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sources Pickup Truck Connected To Wake Deputy S Killing Has Been Found Wral Com

Used Kia Cars For Sale In Raleigh Nc Cars Com

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

What Is Catastrophic Health Insurance Plan In Nc Health Insurance Plans Health Care Coverage Health Insurance